When a company enters liquidation, its ability to continue normal business operations, including entering into contracts, is significantly impacted and, at Bridgewood, we frequently get enquiries from business owners and creditors seeking clarity on this issue. We’ve compiled an overview of the legal framework governing contracts during liquidation with practical advice for stakeholders navigating this complex process.

Understanding Liquidation

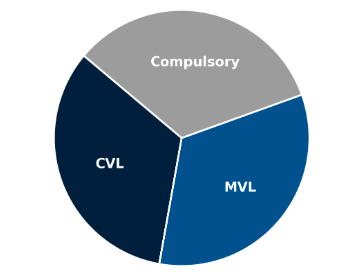

Liquidation is the formal process of winding up a company’s affairs, typically involving the realisation of assets to repay creditors. There are three primary types of liquidation:

- Creditors’ Voluntary Liquidation (CVL): Initiated by the company’s directors when they recognise the company is insolvent and cannot continue trading.

- Compulsory Liquidation: Court-ordered liquidation usually prompted by a creditor’s petition due to unpaid debts.

- Members’ Voluntary Liquidation (MVL): A solvent liquidation process initiated by shareholders when the company has sufficient assets to pay all liabilities.

In each case, an insolvency practitioner (IP) is appointed to oversee the process, manage assets, and ensure compliance with legal obligations. Once liquidation begins, the company’s ability to enter into a contract becomes limited and is subject to specific legal considerations.

Legal Framework for Contracting During Liquidation

Companies in liquidation face stringent legal restrictions regarding contract formation.

Key legal considerations include:

- Liquidator’s Authority: The appointed liquidator assumes control of the company’s assets and affairs, determining whether any contracts can be entered into.

- Existing Contracts: Some contractual obligations remain enforceable, requiring liquidators to assess whether fulfilment is in the best interests of creditors.

- New Contracts: While rare, liquidators may enter into new contracts if they serve the liquidation process, such as agreements to sell assets or settle liabilities.

Conditions Under Which a Company in Liquidation Can Enter into a Contract

Although liquidation restricts a company’s operations, certain scenarios permit contractual engagement:

- Asset Realisation: Liquidators may contract with third parties to sell assets, intellectual property, or business divisions to maximise creditor returns.

- Fulfilling Existing Obligations: If completing an existing contract results in a better return for creditors, the liquidator may decide to allow it to be carried out.

- Legal Approval and Creditor Consent: In some cases, liquidators require creditor approval before entering new contracts, particularly when financial risks are involved.

- Case Law and Precedents: Past legal cases have demonstrated instances where liquidators successfully entered contracts to enable a better liquidation outcome.

Risks and Considerations

There are certain risks when entering into contracts during liquidation and implications for various stakeholders:

- Creditor Interests: Unsecured creditors may object if a contract negatively impacts their expected returns.

- Financial and Legal Risks: Contracts that don’t have proper authorisation may be challenged and deemed unenforceable.

- Insurance and Liability Concerns: Some contracts require insurance, which might not be possible for an insolvent entity.

How can Bridgewood help?

As insolvency practitioners, our role is to provide expert guidance in navigating contractual matters during liquidation. Key best practices include:

- Assessing Contract Viability: Conduct a thorough analysis of whether entering a contract benefits the liquidation process and creditors.

- Managing Creditor Expectations: Transparent communication with creditors about contract decisions helps mitigate disputes and legal challenges.

- Ensuring Compliance: Strict adherence to insolvency laws and regulations is vital to avoid legal repercussions.

- Negotiating Favourable Terms: If a contract is necessary, structuring it to minimise financial risk is essential.

While liquidation makes it harder to take on new contracts, certain circumstances allow it and, essentially, the bottom line in any decision to proceed is whether it benefits the creditors/

Handling a scenario like this requires professional expertise, as making mistakes can lead to legal challenges and financial losses.

Bridgewood will ensure compliance and optimise outcomes for all stakeholders involved. If you’d like an informal chat to discuss your options, please get in touch.